Where The Boom No One Expected Gets Its Legs

Published Friday, September 22, 2023 at: 7:20 PM EDT

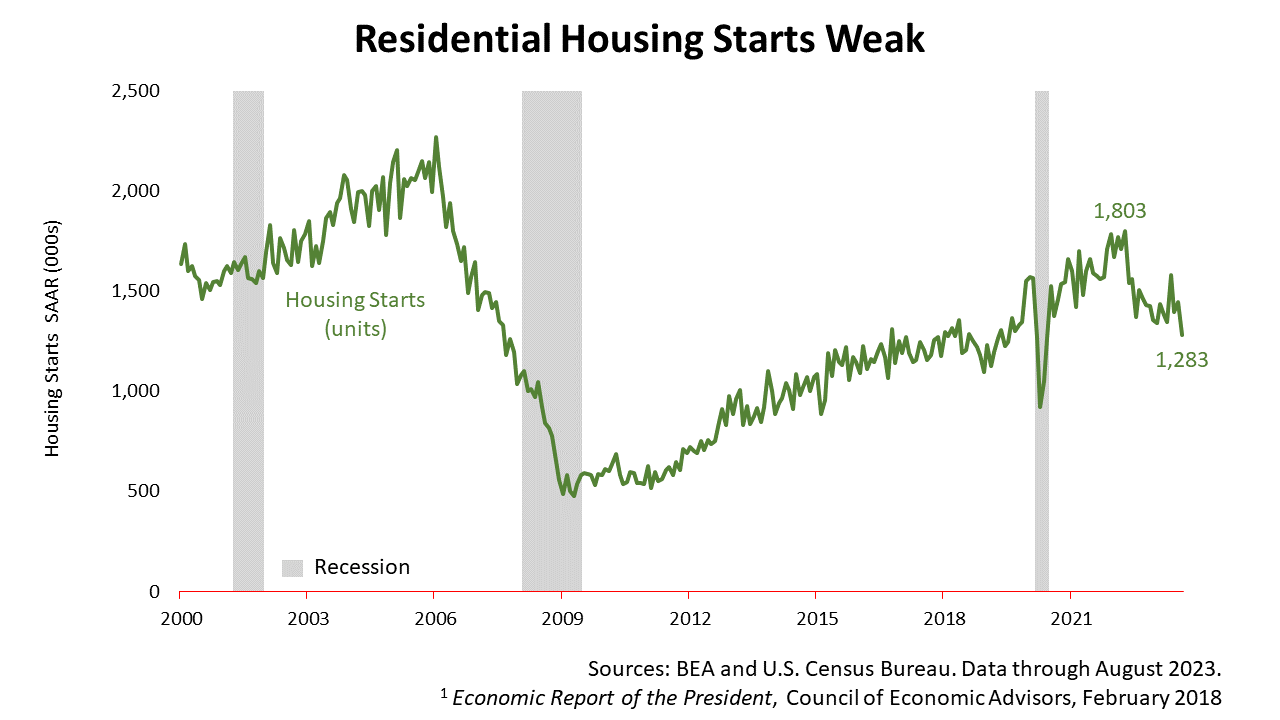

The U.S. economy has been much stronger than expected in 2023. As measured by gross domestic product, the U.S. is growing even though residential housing construction, a key driver of previous U.S. expansions, has been in a slump.

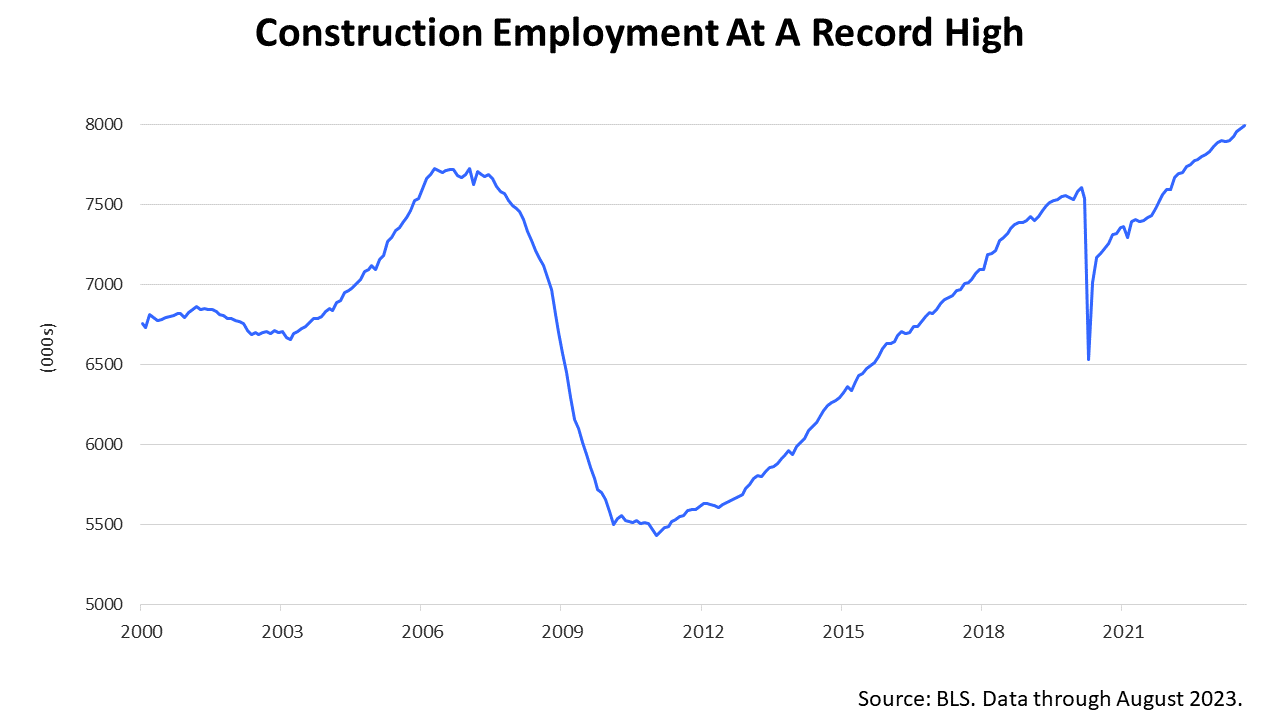

The expansion under way is different from previous expansions. Things are different because of pandemic-related stimulus payments to consumers and businesses and passage of legislation funding improvements to roads and bridges, and manufacturing of computer, electronics, and electrical equipment. A boom in construction of facilities for manufacturing computers, electronics and electrical equipment helps explain the surprising strength of U.S. economic growth.

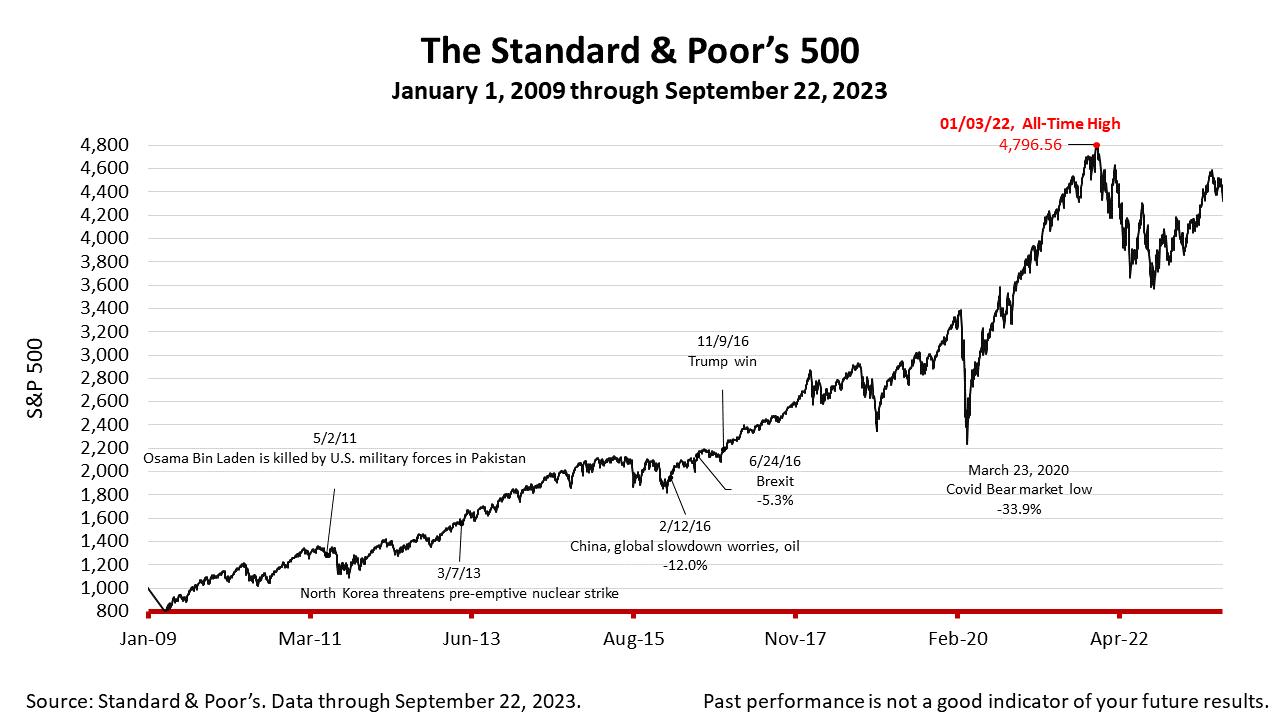

The expansion of 2023 was not expected. In December 2022, the consensus forecast of top Wall Street strategists interviewed in Barron’s, predicted the Standard & Poor’s 500 index would close 2023 at 4000. Except for the last three weeks of March, the stock index has been higher than 4000 all year long.

One of the reasons economic growth has stayed stronger than expected is the boom in U.S. construction of manufacturing facilities under way. It’s a quiet boom that gets little press but makes total sense. The Infrastructure Investment and Jobs Act, Inflation Reduction Act, and CHIPS Act each provided direct funding and tax incentives for public and private manufacturing construction.

Since the beginning of 2022, after-inflation spending on construction of facilities for manufacturing computers, electronics, and electrical equipment nearly quadrupled in the U.S., according to a June 2023 Treasury Department report. Compared with November 2021, real nonresidential construction spending increased by about 15%.

The computer/electronic segment is the dominant component of the U.S. manufacturing construction boom. Importantly, however, the boom in this segment of the construction industry has not come at the cost of reduced spending on other segments of manufacturing construction. In fact, construction spending for chemical, transportation, and food/beverage manufacturing plants is also up from 2022, albeit much less than the spending on building new computer-electronics manufacturing facilities, according to U.S. Treasury data.

The Infrastructure Investment and Jobs Act authorized the federal government to distribute new funds to state and local governments for infrastructure needs tied to roads, bridges, public transit, water, and broadband. That funding has begun translating into spending, the Treasury Department says, explaining the surprising growth in nonresidential construction. It is worth noting that other advanced economies have not experienced similar increases in manufacturing construction, according to roughly analogous data sets examined by U.S. Treasury analysts.

The U.S. economy is very different than it was in previous decades. The effects of the pandemic still reverberate, and massive federal programs to promote or make direct investments in infrastructure and high-tech manufacturing are part of the reason why the boom no one expected has legs.

The S&P 500 stock index has dropped three weeks in a row, losing 2.9% in the week ended September 22, with most of the losses coming after the Federal Reserve’s Wednesday meeting in which central bankers indicated relatively high interest rates would remain unchanged for longer than expected. With the federal funds rate –the lending rate charged by the Fed to the nation’s largest banks -- currently at 5.25% to 5.5%, no decrease in lending rates is expected by Fed policymakers until the second half of 2024. But the main takeaway for investors is that the U.S. economic system is dynamic and adapting to rapid changes, despite the worrisome news that makes headlines daily.

The Standard & Poor’s 500 stock index closed Friday at 4320.06, down -0.23% from Thursday, and -2.93% lower than a week ago. The index is up +93.08% from the March 23, 2020 bear market low and down -9.93% from its January 3, 2022, all-time high.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market-value weighted index with each stock's weight proportionate to its market value. Index returns do not include fees or expenses. Investing involves risk, including the loss of principal, and past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice.

This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice.

2024

-

Stocks Closed At A Record High

Stocks Closed At A Record High

-

Federal Reserve Projects Strong Growth

Federal Reserve Projects Strong Growth

-

The Best People Were Wrong

The Best People Were Wrong

-

This Week’s Investment News In Six Charts

This Week’s Investment News In Six Charts

-

U.S. Investor Picture Of The Week

U.S. Investor Picture Of The Week

-

The Conference Board Backs Off Its Recession Forecast

The Conference Board Backs Off Its Recession Forecast

-

Softening Economic Data, Inflation Fears Dampen Stock Rally

Softening Economic Data, Inflation Fears Dampen Stock Rally

-

S&P 500 Closes Above 5000 For The First Time Ever

S&P 500 Closes Above 5000 For The First Time Ever

-

Why America Is The World’s Economic Leader

Why America Is The World’s Economic Leader

-

Investment News For The Week Ended Friday, January 26

Investment News For The Week Ended Friday, January 26

-

Why Stocks Broke The All-Time Record High

Why Stocks Broke The All-Time Record High

-

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding